1

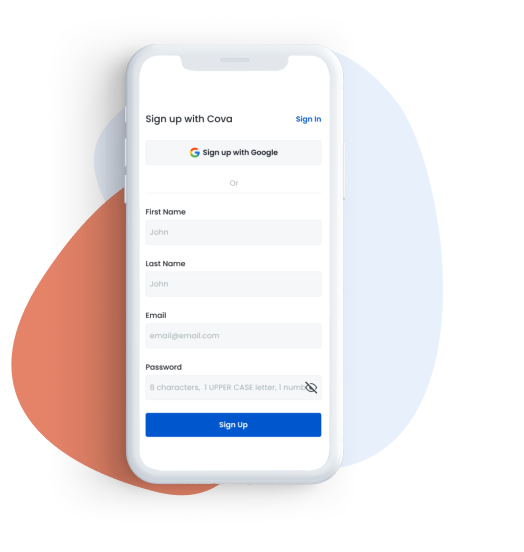

Create an account.

Create a Cova account, choose a plan and enjoy free one-month access to Cova. No need to enter your credit card details. You will be good to go in minutes.

Plan for the long-term

Start organizing your assets, track your net worth, build your digital vault. Take control of your wealth today.